Building Your Financial Security

Building financial security for you and your family is best achieved by creating a clear vision that you can act upon. This vision is best achieved through an interactive planning process which allows you to participate in the creation of your objectives. The solution will provide you with independence and peace of mind, knowing that you are on the right track.

Building financial security for you and your family is best achieved by creating a clear vision that you can act upon. This vision is best achieved through an interactive planning process which allows you to participate in the creation of your objectives. The solution will provide you with independence and peace of mind, knowing that you are on the right track.

There are many elements to the process. You need to fund your personal living and retirement expenses, protect yourself and your family from catastrophic events, and ideally leave a legacy to those you care most about.

Properly assessing opportunity and risk to put together a comprehensive program that cost effectively protects you and your family can be a complicated challenge. We are independent Certified Financial Planners who can help you objectively assess and select the insurance product solutions that best meet your financial security needs whether you are seeking assistance with:

- Life Insurance

- Disability Income Protection

- Critical Illness

- Long Term Care

- Individual Health

- Travel Insurance

Personalized Planning Process Puts You in Control

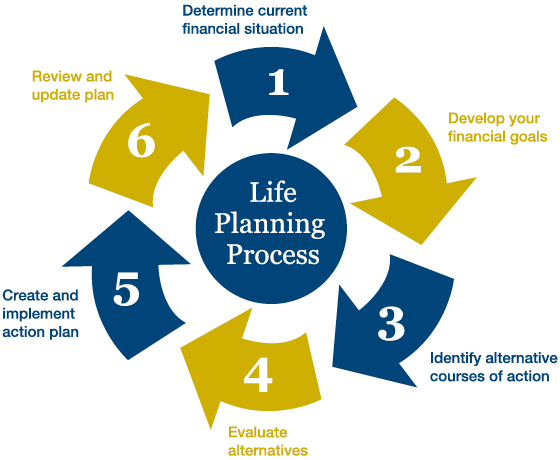

Planning for your future can be an intimidating and challenging exercise. Our life planning approach simplifies financial and insurance planning through an interactive process of personal discovery and analysis, helping you make clear choices necessary to achieve those goals that are most important to you.

Adding Value Through Effective Teamwork

We add value by working with you and your other allied professional advisors such as accountants, lawyers, business valuators and consultants to blend individual skills to create a comprehensive solution that works for you, your family, your business.

Create a Vision of the Future that Reflects Your Values

Our process gives you control and clarity over your financial affairs. We help you create your vision of the future and allow you to assess, and objectively make choices that reflect your core values. No two situations are alike, so we listen intently to appreciate the subtle nuances to help tailor your most suitable outcomes.

Benefit from a Full Range of Personal and Estate Planning Solutions

The Pelorus Transition Planning team helps you achieve peace of mind by creating a road map that can help you address a full range of issues including:

- Cash flow analysis of current and future income needs

- Debt management assistance

- Education planning for children and grandchildren

- Financial independence and retirement planning

- Risk assessment and insurance planning

- Assistance saving for disabled dependants

- Tax planning and preparation referral with financial planning integration

- Estate planning to minimize taxes and leave a lasting legacy

- Philanthropic vision that will maximize the benefit of your bequests

Protect and Maximize the Value of Your Business

Benefit from our years of experience working with many owners of family run business. You face special challenges that require empathy, understanding and a disciplined process built around a team approach that effectively draws upon and links the resources of an expert team of professionals from different disciplines, those who are familiar with the special nuances associated with a family run business. We can help you protect and enhance your wealth, reduce the negative impact of taxes, protect the value of your business and assist with your transition out of the business when the time is right. We work with you and other allied professionals to design and implement advanced financial planning and insurance strategies to achieve your most important goals.

A full range of strategies and products are utilized to:

- Provide Buy/Sell funding strategies for shareholder and partnership agreements

- Multiply the benefit of the Small Business Capital Gains Exemption

- Protect the $750,000 Small Business Capital Gains Exemption

- Protect the business from the loss of a key employee

- Attract and retain key employees

- Implement creditor protection strategies

- Provide income splitting opportunities

- Support estate freezes to transfer wealth to the next generation

- Defer income taxes and tax effectively move money out of the company